How do you start using technical analysis trading forex this year, even if you’re new? If you’re new to forex trading and want to know how to start, you’re in the right place. You’ll want to read this post. If our 8-Week Challenge taught us anything, it reveals that there are many ways to get to your end result.

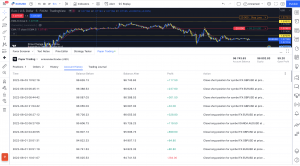

What if you’re new to trading forex or any asset class? This is the exact method we’d suggest. This strategy resulted in the following results this week.

Forex Trading Strategy

This is a simple forex trading method, perfect for new traders. There are 6 steps to this. Let’s begin.

STEP 1: SETUP YOUR CHART

STEP 2: ADD TWO (2) EMAs

STEP 3: WAIT FOR ENTRY SIGNAL

STEP 4: ENTER & ANALYZE

STEP 5: WAIT FOR EXIT SIGNAL

STEP 6: EXIT & ANALYZE

Setting Up Your Chart To Trade Successfully (Steps 1 & 2)

How do you setup your chart for trading success? This is not the only way to get great results from your trades. However, when you’re new, you need something you can depend upon and this will give you the boost of faith in yourself that you deserve as a new trader.

We’re not into the default red/green candles that come with many trading platforms. So, in honor of Zane’s alma mater the Wolverines, we’ve selected good ole maze and blue. Hail to the victors!!

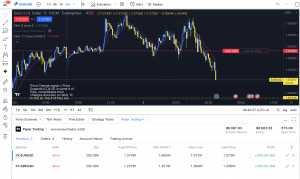

Next, add two Exponential Moving Averages. Hey, hey, don’t leave yet… lol. Most ‘experts’ will shout at you NOT to use EMAs as trading signals. For the most part, that’s spot on. We don’t want you to rely 100% on EMAs however, you’ll soon see why this is so powerful and the results available to you will shock you.

Exponential Moving Averages For Technical Analysis

The two EMAs we use are the 8-Day and the 17-Day moving averages. We use them for different types of confirmations on specific timeframes.

If you’re a fan of ICT (Inner Circle Trader) Michael talks about opportunities to enter trades during the Asian Session. If you haven’t checked out his video series specifically on the Asian timeframe, it’s worth watching.

If you haven’t, not to worry. I’ll summarize here and will show you examples so that you can get started practicing right away.

By using the two EMAs, you’ll see that around 20:00 EST (pardon, my military talk) 8:00pm EST for civilians, there often presents an opportunity to enter a trade. You can tell because on the 5-minute chart, you’ll see this below.

Ideal Time Frames to Trade Forex

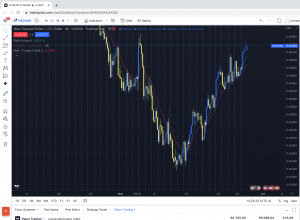

There is more than one ideal time frame to trade forex. Through trial and error and a lot of practice, we’ve found that entering trades on the 5 or 15-minute chart gives us the best trading results because it’s easier to see if we’re above or below the Asian’s opening price.

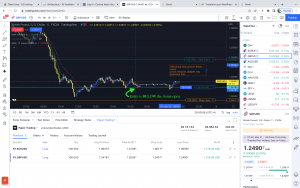

Your aim is to identify if the new trading day will be predominantly long or short. If long, you’ll want to enter below the opening price, if short, do the opposite and sell short above the sessions’ initial price. This is a key move for your trading results.

“Waaaaiiitt!?” You say, “… but how do I know how to buy or sell?”

Got it, let’s get to that right now. This is going to be the easiest part for you. First things first, get an idea of what’s been happening on the higher time frames. It’s easiest to start with the 1hr, then go to the 4hr, then the Daily, Weekly then the Monthly charts.

If the 1hr chart shows that the 8EMA is above the 17EMA, and around 8:00pm EST price for a short period of time, at least until after the London open, price will usually continue moving up.

The key here is that price needs to be near the one of the EMAs as you take your trade. If price is too far away, wait until price moves up or down. Remember, the EMAs need to be close together (either touching or close to touching) as you’re entering your trade. That’s the “secret” to consistent results.

The aim is to know where the most “pressure” resides. For example, larger moves, up or down, come from the dominant direction. If on the Monthly and Weekly charts are both going up, you’ll typically get longer trading runs (more sustained moves) when you’re a buyer.

Most days, you’ll have a chance to get results buying or selling. It’s the reading of the 5-minute to 4hr time frames that will allow you to find these great trades. My hope for you is that you’ll now be able to find them with this great trading strategy.

Once you’ve entered the trade, the next two hours are important, you’re going to analyze your trade entry and determine if you’ve selected the right direction. Typically, after 1 to 2 hours you’ll know with a high degree of certainty that you’re on the right track.

How To Analyze Your Trades For Success

Most trades you can tell right away, within a few moments if not minutes, that your analysis was successful. When you analyze, you’ll looking for two things:

- Does your entry price remain above (if below) or below (if long)?

- If not, can you justify staying in the trade?

Sometimes you’ve selected the correct direction and your price goes in the opposite direct. This is will be typical with this trade because depending on when you enter between 8:00pm-10:0pm EST, the markets will continue to gravitate towards “liquidity” or orders from large institutions.

Stop losses are a large key to my success with trading. I show up daily and plan to gain favorable results. In order to keep what’s in my trading account safe from untimely or adverse market conditions, a 20-30 pip stop loss is placed automatically with each trade.

Recap on how to Trade Successfully

This is a trade that takes place during the Asian timeframe a few hours after the open. It can last until the next morning or until the end of the week.

I’m sharing this with you because my aim is to be the most helpful Forex Trader. That way, you can reach your goals faster than having to pay thousands of dollars for a course. Don’t get me wrong, there’s nothing wrong with courses, I’ve purchased a couple don’t mind because, I’m here to learn as much as possible. The more I learn, the better I’m able to guide new traders towards victory.

Back to you. Now that you know when to trade, the setup of how it may look before, during and when you’ll exit, let’s quickly review your goals.

What goals do we have each day? We focus little on the amount of return we’ll receive. The point of trading is to become consistent with your trading plan so that little-by-little or trade-by-trade, your account balance naturally grows.

I used to be in a hurry to see success and that never worked. I made more mistakes and didn’t correct them quickly enough to keep my interest in growing as a trader. Mindset is another factor that keeps many traders on the sidelines instead of blossoming into a professional trader.

Now, I realize that I’m not trading alone. Neither are you. You have “trading guides” with you all the time, ready to assist you. This may sound strange, however, I know it’s true. When I focus in a particular way, sitting in gratitude and faith in our co-abilities, trades work out. My timing is perfect and accurate.

Take the results from this week. You can tell when I was “in flow” and when I wasn’t. That’s why I say “we” here. I am co-creating with my trading guides who are here for you, too.

What goals should you have, if not on how much you’ll make each week? It’s good to know generally what you could earn each trade, that’s why I use trade view (set hyperlink), so that their system tells us automatically what might be made available to us. However, it’s not my main focus. I want to know based on where I’m entering, where’s a likely area the market will pull back or reverse. That’s where I set my exit.

It’s usually 60ish pips per trade. If I trade $5 – $50/pip, then I can approximate the return on each trade. The great thing is, there’s always another trade we can enter the next day, should that trade miss the mark.

Your goal is to get enter your trade, lower (going long) or higher (going short) than the opening price during the Asian session. You can do that by monitoring where price is in relation to the EMAs, is price between them on the higher timeframe? Or are the EMAs close togethe on the 5-minute or 15-minute charts? Great, get in!

You’ll develop a natural feel for this. You’re a natural at trading even if your current results don’t match your goals. You’ve got this! Plus, you can return to this post often as a reference.

We’ve covered a lot of ground today. You should feel proud of yourself for taking steps to improve your trading results. Thanks for being here and on this planet!

Thanks for reading and if you want a copy of this trading checklist, grab your copy here.